20/02/ · Home > Bollinger Bands Trading Strategy. Bollinger Bands are a technical analysis indicator that is developed by John Bollinger. It is useful for finding overbought/oversold areas and also helps traders to identify the market volatility. It is commonly used as a reversion to the mean blogger.comted Reading Time: 5 mins This bollinger band strategy is a continuation trading strategy that also uses the 20 period moving average of the bands for trend direction. Bollinger bands are a good measure of volatility of the instrument you are trading and we can use this to form the basis of a swing trading system for Forex or any other blogger.comted Reading Time: 5 mins 04/11/ · Bollinger Bands is one of the most popular and broadly used trend-following indicators for forex and stock trading. In this video you’ll discover:• What is t Author: The Secret Mindset

Tales from the Trenches: A Simple Bollinger Band® Strategy

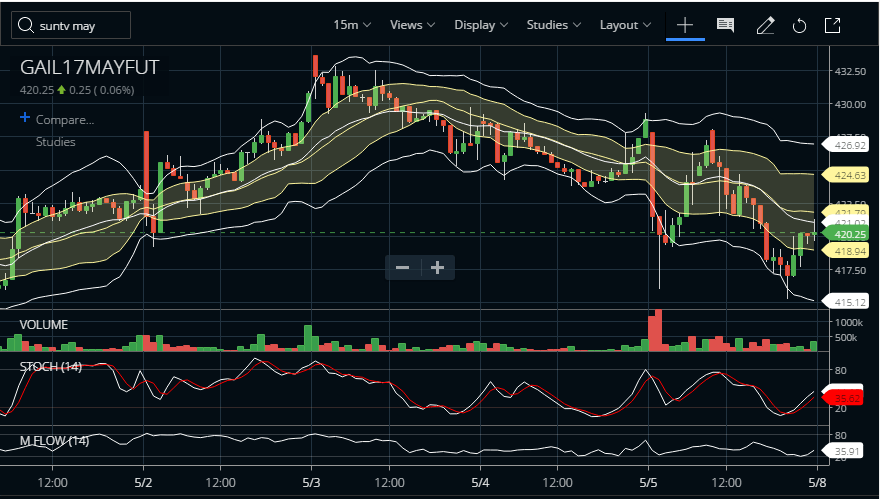

Bollinger Bands are one of the most popular trading indicators, trading bollinger bands strategy. Bollinger Bands use the basic statistical concept of standard deviation. For this, it is easy to understand. Bollinger Bands form an envelope around price action. It does not trading bollinger bands strategy your attention with an extra indicator panel and augments price action analysis. The market exhibits volatility cycles, trading bollinger bands strategy.

Low volatility markets shift gears into high volatility before subsiding back into subdued action. Hence, finding low volatility periods will position you well to trade the subsequent breakout. Bollinger Bands are helpful here because its width reflects market volatility. If the bandwidth is at a record trading bollinger bands strategy, you should stay out of the market and prepare for the eventual breakout.

This a simple trading strategy uses Bollinger Bands as trade triggers. As Bollinger Bands reacts to market volatility, it acts as a dynamic trigger for breakout trades. In a volatile market, it requires price action to move more to trigger a trade. In a quiet market, a smaller price move is needed to trigger a setup.

This strategy is one of my favorites as it uses Bollinger Bands to clarify chart patterns. In this case, we are focusing on double bottoms and double tops or W-bottoms and M-tops respectively, trading bollinger bands strategy. To learn more, refer to this tutorial by Stockcharts. com which has a few helpful examples of this strategy. Gimmee Bar is a concept by Joe Ross — one of the earlier traders to focus on short-term price patterns. It takes advantage of the fact that a sideways market tends to stay within the Bollinger Bands.

This strategy looks merely for the right price patterns to buy low and sell high within a trading range. Click here for the trading rules and more examples of the Gimmee Bar setup. Yes, there are many more Bollinger Bands trading strategies out there. Leave a Reply Cancel reply Your email address will not be published. Download for free now. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your trading bollinger bands strategy. Please click the consent button to view this website.

I accept. Deny cookies Go Back. Trading Setups Review About Us Contact Us Advertise With Us Privacy Policy Affiliate Disclaimer Full Risk Disclosure. Learn More Day Trading With Price Action Course TSR Trading Guides Trading Setups Trading Articles Trading Books Site Map.

Learn a new powerful price pattern today!

BEST Bollinger Bands Breakout Strategy For Daytrading Forex (Bollinger Bands Tutorial)

, time: 9:32The Bollinger Bands Trading Strategy Guide

10/08/ · The Bollinger bands trading strategy is used to know the value of price levels. It tells that where the price value will high or low. The Bollinger bands trading is a market trading indicator that helps to point out the buy and sell signals, price up and price low levels and the market overbought and oversold conditions This bollinger band strategy is a continuation trading strategy that also uses the 20 period moving average of the bands for trend direction. Bollinger bands are a good measure of volatility of the instrument you are trading and we can use this to form the basis of a swing trading system for Forex or any other blogger.comted Reading Time: 5 mins 04/11/ · Bollinger Bands is one of the most popular and broadly used trend-following indicators for forex and stock trading. In this video you’ll discover:• What is t Author: The Secret Mindset

No comments:

Post a Comment