19/04/ · Although the practice originated in the executive ranks, some companies, including many start-up firms, now make stock options a part of every employee's compensation. The option grants must be recorded on the company's financial statements, and if an employee leaves the company, the financial statements need to reflect the decrease in compensation expense since the employee forfeited his blogger.com: Cynthia Gaffney 21/12/ · A company’s grant of stock options provides an incentive for executives to contribute to the company’s long-term success, and the stock option with Sample 2. FORFEITURE OF STOCK OPTIONS. Rhodes hereby acknowledges and agrees that his resignation is voluntary and that, pursuant to the terms of the Bank ’s Employee Stock Option Plan, such voluntary resignation shall result in the immediate forfeiture of all outstanding stock options currently held by Rhodes, whether vested or unvested

How to Account for Forfeited Stock Options | Pocketsense

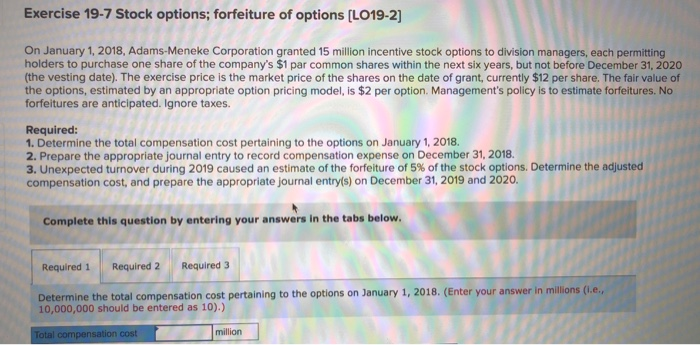

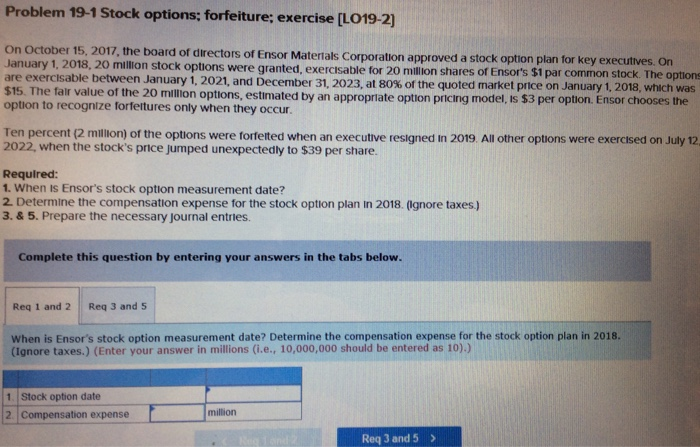

Employers grant stock options as part of a compensation package to employees. Although the practice originated in the executive ranks, some companies, including many start-up firms, now make stock options a part of every employee's compensation. The option grants must be recorded on the company's financial statements, and if an employee leaves the company, the financial statements need to reflect the decrease in compensation expense since the employee forfeited forfeitures of stock options options.

Verify that the employee terminated employment before completing the vesting period for his stock options. Stock option awards usually vest based on meeting certain performance or service conditions.

Vesting means the employee can now exercise his options and convert them to company stock. Confirm vesting conditions for the stock options. If the option vesting period was contingent upon a certain market condition, and the market condition does not occur before the employee terminates, the stock forfeitures of stock options expense is not reversed on the financial statements.

Make a journal entry to reverse the expense related to the forfeited stock options out of the compensation expense account. She has worked as a financial writer for online finance publications sinceincluding eHow Money, The Motley Fool, and Sapling. She has also edited for several online finance publications, including The Balance, Opposing Views:Money, Synonym:Money, and Zacks. A Southern California native, Cynthia received her Bachelor of Science degree in finance and business economics from USC.

MANAGING YOUR MONEY. length { this. removeChild sources[0] ; } else { this, forfeitures of stock options. querySelectorAll 'source' ], arguments[0]. Share It. Verify the reduced compensation expense on the company's income statement. References FindLaw.

com: Understanding the New Accounting Rules For Stock Options and Other Awards Internal Revenue Service. Accessed Aug.

Options Trading for Beginners (The ULTIMATE In-Depth Guide)

, time: 2:53:42FORFEITURE OF STOCK OPTIONS Sample Clauses | Law Insider

10/11/ · For every year that options are granted, you must estimate the forfeitures for the following four years. The amount of forfeitures generally trends downwards after every year. For example, consider that you grant options for the equivalent of one million shares in , and in the first year of vesting (), approximately 20% of the shares are blogger.comted Reading Time: 5 mins 19/04/ · Although the practice originated in the executive ranks, some companies, including many start-up firms, now make stock options a part of every employee's compensation. The option grants must be recorded on the company's financial statements, and if an employee leaves the company, the financial statements need to reflect the decrease in compensation expense since the employee forfeited his blogger.com: Cynthia Gaffney 21/12/ · A company’s grant of stock options provides an incentive for executives to contribute to the company’s long-term success, and the stock option with

No comments:

Post a Comment