My Daily Forex Transaction Volume name is Dennis Zeigler and I was trading with a company called Janus Options and changed the name to Ax Trades I was working with a man by the name of Ernest ride and he kept saying I had to give him Daily Forex Transaction Volume money for all kinds of things to make a withdrawl and every time I gave it he promised I could WD but never did I'm out of , 08/05/ · The last data was provided in , which means that this year will see the release of the Triennial FX Market Survey, which will show the latest figures for FX turnover. Indeed, this report is 09/09/ · Forex market daily activity has seen an increase from US$ trillion in to US$ trillion in The global Forex trading market is worth $2,,,, (that is $ quadrillion). Forex is the only market that runs for 24 hours a day (except for weekends).Estimated Reading Time: 9 mins

How Banks Trade Forex? - Forex Education

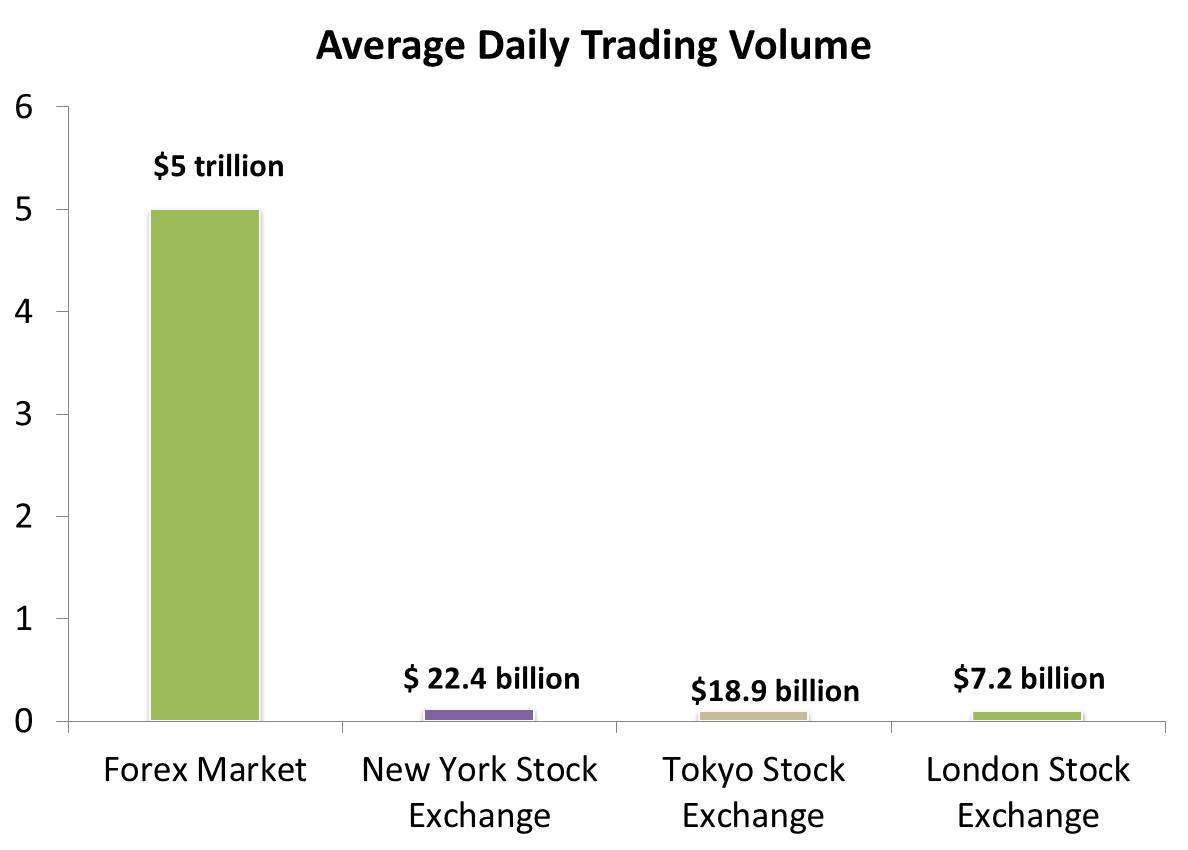

The forex market is the biggest financial market in the world. Yet, it is one of the few financial markets that do not have a physical exchange or location. Forex trades emanate from the network of banks that act as the liquidity providers, and daily forex transaction volume aspect of the market is known as the interbank FX market. The mere fact that the FX market is borderless and is a virtual marketplace has contributed to make this market the largest in the world, daily forex transaction volume.

A virtual location can therefore absorb millions of people from all over the world in real-time, connecting with the computers or hand-held devices using the internet. An individual can in a matter of minutes, transit from someone who knows next to nothing about FX and actually place the first trade in the market. This has been made possible because of the internet and the placement of the FX market as a virtual, internet-driven marketplace.

How big is the FX market in terms of liquidity? The Bank of International Settlements BIS provides data on the liquidity of the FX market every three years. The last data was provided inwhich means that this year will see the release of the Triennial FX Market Survey, which will show the latest figures for FX turnover.

Indeed, daily forex transaction volume, this report is expected to be released in December This figure can further be broken down as follows:. On the trading side of things, the market participants are divided into the institutional traders hedge funds, investment banks, large portfolio managers and the retail traders individual traders.

Think of the FX market as an arena where there are wholesalers and retailers. The institutional participants make up the majority of all forex transactions in the market. These figures are significant for a number of reasons. Firstly, the institutional traders drive the market volume and will therefore drive market direction.

Secondly, the brokerage conditions that suit institutional trading differ from retail brokerage conditions and generally affect performance and outcomes. This is why most institutional trading desks make a huge profit, but most retail traders fail. This is gradually leading to the emergence of investment products that provide institutional conditions, but which are targeted at retail traders.

An understanding of these numbers is very necessary for retail traders. The domination of trading volumes by the institutional traders pushes the market trends. This is why retail traders are advised to trade with the trend and not try to buck it. What countries are the major FX trading zones in terms of volume of trades? Again, we turn to the BIS Triennial Survey which found that the top 3 countries by FX volume continue to remain the United Kingdom, the United States and Singapore.

This is why these three countries are used to classify the FX trading hours and we speak of the London, daily forex transaction volume, New York and Asian time zones. Top 10 Countries By Turnover of OTC FX Instruments, daily forex transaction volume. Source: Bank of International Settlements. Structure of the Global FX Market. Source: FXTAA. This is also the reason why FX trading volume on a day-to-day basis is heaviest when the London and New York time zones overlap, and is also why the Asian time zone sees the lightest trading volume of all three FX trading time zones.

You should also take note of the fact that the US Dollar, Euro and British Pound are heavily traded during the London and New York time zones, daily forex transaction volume. This is an interplay of factors which explains why FX volumes are highest at certain times, what currencies are the most traded by volume, and why some currencies will continue to attract more interest than others.

This section showcases the currencies that dominate the market liquidity and offers reasons as to why some of these currencies find themselves at the top of the liquidity chain. In descending order, this is a list of the most traded currencies in the world. The snapshot below indicates just how the daily market turnover is spread out across the currency pairs that have daily forex transaction volume listed above, daily forex transaction volume.

Turnover of OTC FX Market: BIS Triennial Market Survey. One of the important statistics that emerged from the last FX market survey of the BIS in was the emergence of the Chinese Yuan in the list of the top 10 liquid currencies. Trading volumes of the Renminbi have been climbing steadily, with most of it being driven by trading in offshore deliverables priced in CNY as well as a lot of trading of FX swaps.

Most of the trading of the Renminbi continues to be dominated by its pairing with the US Dollar. The forex market is the biggest and most liquid financial market in the world. Its size is what boosts its liquidity. Comparison of Daily forex transaction volume Market Size with Equities and Futures Market: Image Sourced from DailyFX. Liquidity is what enables a trader to get orders matched instantaneously.

Despite the domination of the liquidity pools by the institutional traders, and the lack of capacity of retail traders to engage such liquidity, the market still functions effectively. This is because the gap between the institutional pool and the retail traders has been bridged effectively by the market makers.

While the world awaits the results of the latest Triennial Survey by the Bank of International Settlements, traders should realize that the size and liquidity of the FX market brings advantages and these can be utilized positively in trading activity. Necessary cookies are absolutely essential for the website to function properly, daily forex transaction volume.

This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, daily forex transaction volume embedded contents are termed as non-necessary cookies.

It is mandatory to procure user consent prior to running these cookies on daily forex transaction volume website. Copyright © All Rights Reserved. Best Forex Broker About Us Privacy Policy Terms Risk Disclosure Sitemap Contact. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Do not sell my personal information. Cookie settings ACCEPT. Manage consent. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We daily forex transaction volume use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent, daily forex transaction volume.

You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary. Non Necessary non-necessary.

Best Volume Indicators You Can't Afford To Miss (Volume-Based Trading For Forex \u0026 Stock Market)

, time: 10:09Forex Trading Statistics + Industry Guide [Fact Checked]

16/09/ · London Summit Launches the Latest Era in FX and Fintech – Join Now This overshadowed a 20 percent increase in spot trading, for which the average daily volume climbed by $ billion to $ trillion between and As such, the share of spot trades in global FX activity fell to 30 percent in , down from 33 percent in Estimated Reading Time: 4 mins 09/09/ · Forex market daily activity has seen an increase from US$ trillion in to US$ trillion in The global Forex trading market is worth $2,,,, (that is $ quadrillion). Forex is the only market that runs for 24 hours a day (except for weekends).Estimated Reading Time: 9 mins My Daily Forex Transaction Volume name is Dennis Zeigler and I was trading with a company called Janus Options and changed the name to Ax Trades I was working with a man by the name of Ernest ride and he kept saying I had to give him Daily Forex Transaction Volume money for all kinds of things to make a withdrawl and every time I gave it he promised I could WD but never did I'm out of ,

No comments:

Post a Comment